ST. PATRICK’S day

Join us for a St. Patrick’s Day celebration like no other, with unbeatable deals that will make you feel lucky!

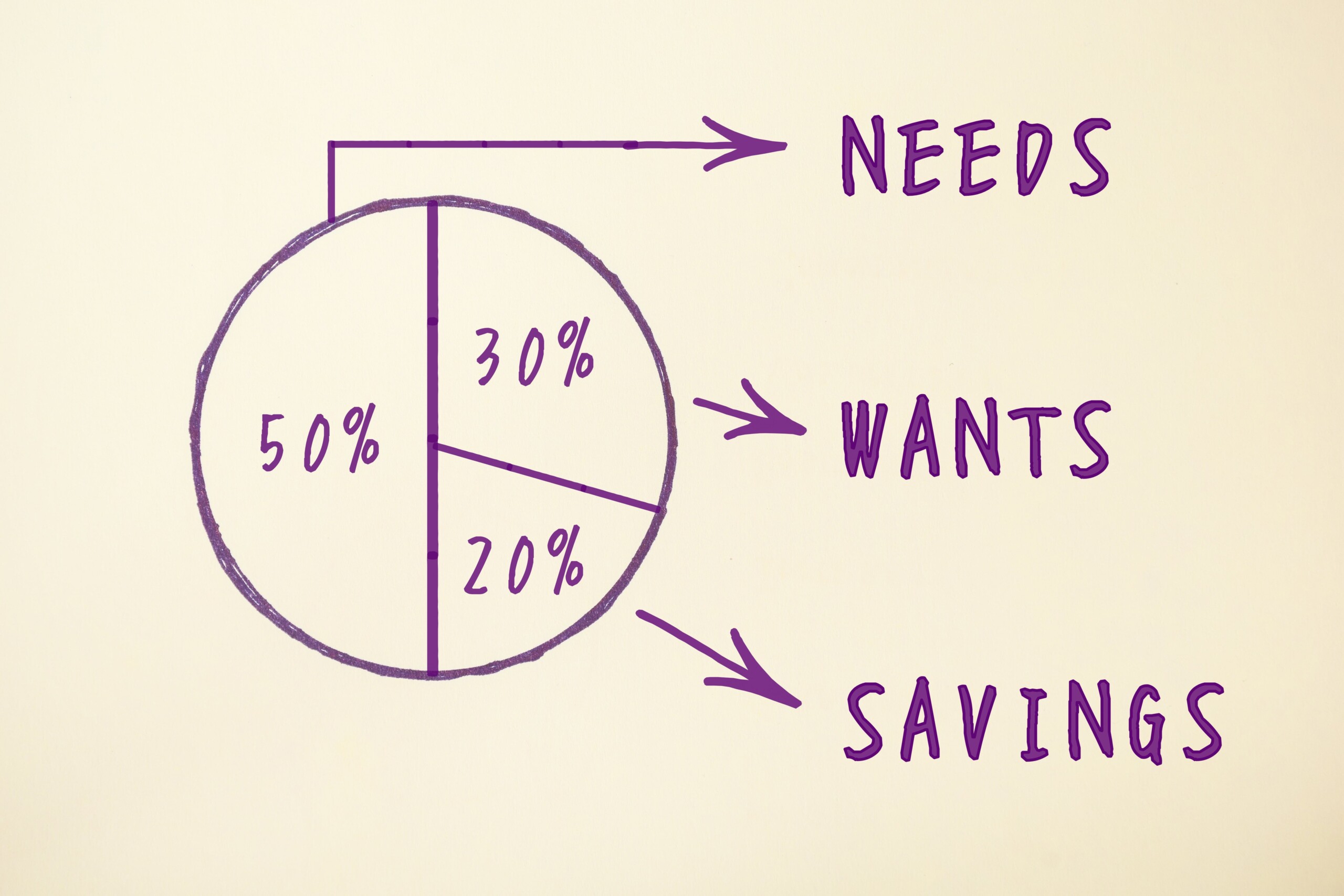

Budgeting is a fundamental aspect of financial management, helping you allocate your income effectively to meet your needs, wants, and savings goals. One popular and straightforward budgeting strategy is the 50/30/20 Budget Rule. This rule divides your after-tax income into three categories: 50% for needs, 30% for wants, and 20% for savings and debt repayment. Here’s a comprehensive guide to understanding and implementing the 50/30/20 Budget Rule.

The 50/30/20 Budget Rule is a simple and effective budgeting strategy that helps you manage your finances by dividing your after-tax income into three main categories:

This category covers essential expenses necessary for daily living. These are nonnegotiable costs that you must pay to maintain a basic standard of living. For example, if your after-tax income is $4,000, you would allocate $2,000 for needs. Needs include:

Allocating 50% of your income to these needs ensures that you cover all the essentials without compromising your financial stability.

This category includes nonessential expenses that enhance your lifestyle. Wants are the things you desire but do not necessarily need to survive. With a $4,000 after-tax income, you would allocate $1,200 for wants. Examples include:

By allocating 30% of your income to wants, you can enjoy life and indulge in activities that bring you joy and satisfaction, without going overboard.

This category is dedicated to building your financial future and reducing existing debt. Savings and debt repayment are crucial for achieving long-term financial health. For a $4,000 after-tax income, you would allocate $800 for this category. Examples include:

Allocating 20% of your income to savings and debt repayment helps you build a financial cushion, prepare for future needs, and work toward financial independence.

The straightforward division of income makes it easy to understand and implement. This simplicity can help you stay consistent with your budgeting efforts. Unlike complex budgeting systems that require detailed tracking and categorization, the 50/30/20 rule’s clear guidelines make it accessible for everyone, regardless of their financial expertise.

By allocating funds for both needs and wants, this budgeting strategy ensures that you can cover essential expenses while still enjoying life. This balance prevents the feeling of deprivation that often accompanies strict budgets, making it easier to stick with your financial plan in the long term. You can pay your bills and still have money left over for activities and items that bring you joy and satisfaction.

Dedicating 20% of your income to savings and debt repayment helps you build a financial cushion and reduce debt over time, promoting long-term financial health. This approach ensures that you are consistently working toward financial goals, such as building an emergency fund, saving for retirement, or paying down high-interest debt, which can significantly improve your financial stability.

The rule can be adjusted to fit your unique financial situation. If your needs are higher, you can adjust the percentages slightly while still maintaining the overall structure. For instance, if you live in an area with a high cost of living, you might allocate 55% for needs and reduce the percentages for wants and savings. The flexibility of the 50/30/20 rule allows you to tailor it to your personal circumstances while keeping a balanced approach to budgeting.

Use a budgeting app or spreadsheet to track your expenses and ensure you stay within the allocated amounts for each category. Tracking helps you identify areas where you might be overspending and allows you to make necessary adjustments to stay on track.

Periodically review your budget to make sure it aligns with your financial goals and adjust as needed. Life circumstances change, and your budget should reflect those changes. Regular reviews can help you stay proactive about your financial health and make informed decisions about reallocating funds.

If you have high-interest debt, consider allocating more than 20% of your income to pay it off faster. Reducing debt can free up more money for savings and wants in the future. Prioritizing debt repayment can reduce the amount of interest you pay over time, helping you achieve financial freedom more quickly.

Set up automatic transfers to your savings account to ensure you consistently save a portion of your income each month. Automating your savings removes the temptation to spend the money elsewhere and ensures that you are consistently working toward your financial goals.

Take advantage of sales, coupons, and special promotions to save money on everyday purchases. Being mindful of discounts and deals can help you stretch your budget further and allocate more money toward your savings. Many places have apps that allow you to see deals, earn points for coupons, and take advantage of special promotions.

For instance, at Ruby Tuesday, we’re offering daily deals for under $10 every day of the week, plus new everyday meal deals starting at $8.99, available for dine-in, takeout, or through the Ruby Rewards app. This allows you to enjoy meals out, without exceeding your budget.

Embrace the 50/30/20 Budget Rule and take control of your financial health while still enjoying life’s pleasures. By managing your finances effectively, you can cover essential expenses, save for the future, and indulge in enjoyable activities without guilt.

Remember, sticking to your budget doesn’t mean giving up on dining out. Take advantage of Ruby Tuesday’s daily deals, plus our new everyday meal deals starting at $8.99, available for dine-in, takeout, or through the Ruby Rewards app. These delicious and affordable meals allow you to enjoy a great dining experience without breaking your budget. Start implementing the 50/30/20 Budget Rule today, and savor both your financial success and the flavorful offerings at Ruby Tuesday!

As you work on managing your budget, take advantage of Ruby Tuesday’s Summer of Savings Sweepstakes. This is a fantastic opportunity to enhance your financial strategy. By entering your email and spinning the wheel, you could win amazing prizes including $1,000,000, exciting race car and Las Vegas experiences, and various gift cards. Additionally, there are numerous instant win food prizes like appetizers, entrees, and desserts, which can help you enjoy great meals without impacting your budget. Visit the Ruby Tuesday Summer of Savings Sweepstakes to enter and make your summer even more rewarding!